Family Health Insurance

What Is Family Health Insurance?

One of the key differences between family health insurance and individual coverage is that you and your loved ones are all protected under the same plan. Enrolling in a family plan is often considered the first step towards a healthier life for not only yourself but everyone on the policy. You will all have access to the same level of care and benefits, but your deductible structure will be a bit different.

While these plans are designed to cover multiple people on the same policy, health insurance plans for families do have some restrictions in who you can add. For the most part, you’ll be limited to only adding dependents to your policy who need to meet certain criteria, although your spouse and child usually qualify.

How Family Medical Plans Work

There’s not a huge contrast between family and individual plans, but they do have some differences worth noting. First, and most obviously, with family coverage you’ll have the ability to add more people to a single policy, which means big savings compared to getting an individual plan for everyone. Secondly, which is often the most confusing aspect, is how out-of-pocket costs are structured. Other than that, family health insurance plans work almost identically to the individual coverage you may be used to.

You, the head of the household, find a plan that fits everyone’s needs. Once enrolled, you’ll pay a premium, which is typically billed monthly. In return, your health insurance provider will offer you financial assistance for any medical expenses you may incur through the duration of your coverage. Remember, you’ll still be liable to pay some of your medical bills yourself, but it will be significantly cheaper than paying for everything out of your own pocket.

Understanding Your Family Deductible

In the simplest sense, health insurance deductibles refer to the amount of money you have to pay out of your own pocket towards your medical bill before your health insurance plan kicks in to cover any remaining balance. Deductibles can be a bit confusing, but you can get a more in-depth understanding of your out-of-pocket cost here.

With individual plans, deductibles are a bit more straightforward because there is only one person on the policy and you only need to worry about one deductible. What happens with family health insurance plans that have multiple people on the same policy?

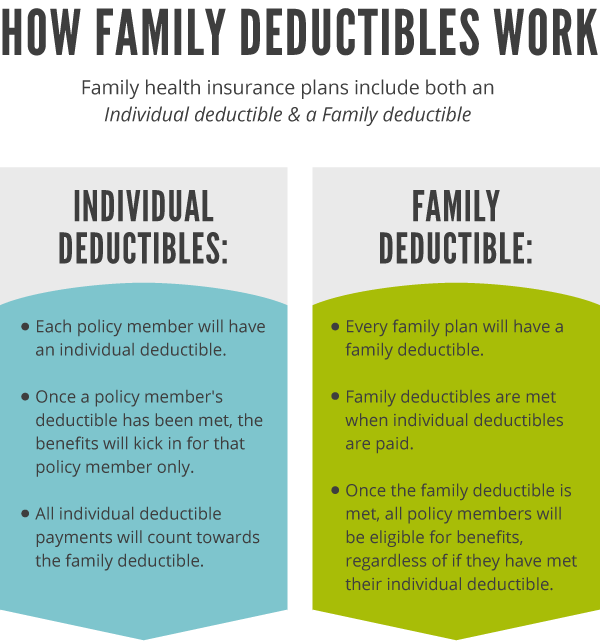

Family deductibles are a bit more complex because there will typically be two separatedeductibles to track. The first would be the individual deductible for each family member on the policy, and the second would be the total family deductible. Here’s a breakdown of each.

- Individual Only Deductible: Each member of the policy will have an individual deductible that needs to be met before benefits kick in unless the family deductible has already been met. Each time an individual deductible payment is made, it counts towards the family deductible.

- Family Deductible: The combined deductible for all members of the policy. Once you meet the family deductible, your health benefits will kick in to cover remaining medical costs for each member of the policy regardless of it they have met their individual deductibles.

A Real World Example

If family deductibles are still a bit confusing, here’s a real-world example to clear things up.

A family enrolls in a health insurance policy which covers all 5 members. The monthly premium is $530, and the policy comes with an individual deductible of $750, and a family deductible of $2,000.

Currently, this is where the family deductible stands:

- Family Deductible: $2,000

- Member 1: $750

- Member 2: $750

- Member 3: $750

- Member 4: $750

- Member 5: $750

During the first month of the policy, Member 5 breaks their arm. The doctor’s visit and the cast come out to a total of $500. Here is where the deductibles stand after the $500 deductible is paid:

- Family Deductible: $1,500

- Member 1: $750

- Member 2: $750

- Member 3: $750

- Member 4: $750

- Member 5: $250

The $500 payment went towards Member 5’s individual deductible, and towards the family deductible. For Member 5, benefits will kick in to cover medical costs after another $250 has been paid towards the individual deductible.

During the fourth month of the policy, Member 1 is in a car accident and needed medical attention. After a night stays in the hospital, Member 1 receives a bill for $1,500. After paying the individual deductible of $750, the policy benefits kick in to cover the remaining $750. Member 1 has now paid all of their individual deductibles and will be covered for all medical costs for the rest of the year. The $750 payment will also be applied to the family deductible. Here’s where all of the deductibles stand now:

- Family Deductible: $750

- Member 1: $0

- Member 2: $750

- Member 3: $750

- Member 4: $750

- Member 5: $250

Halfway through the year, Member 3 has an allergic reaction and needs to be rushed to the hospital. The total bill for treatment comes out to $1,000, which means after paying $750 for treatment, both the individual and family deductible has been met. So even though not every member of the policy has met their individual deductible, health benefits will cover the cost of medical costs for each member for the remainder of the policy duration.

The Best Health Insurance Plans For Families

There is not a single best family health insurance plan, but there are plenty of companies with great reputations and reviews for you to choose from. When looking for the best family healthcare plan, the first thing you want to do is establish your family needs and the budget you are working with. However, the following are highly rated health insurance companies that offer a variety of family health insurance plans that will surely fit your needs.

Picking Coverage To Fit Everyone’s Needs

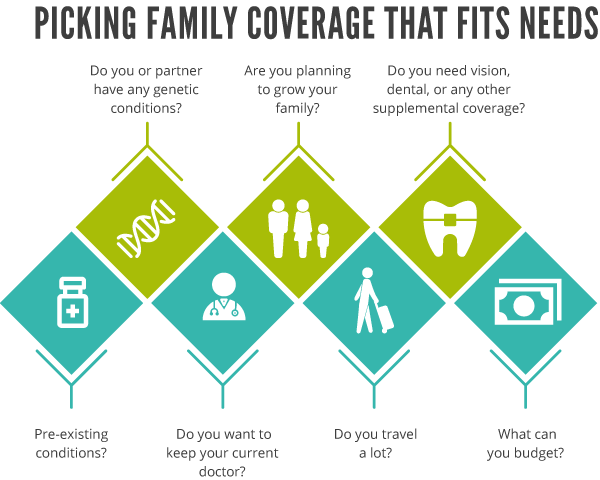

When picking family coverage, you want to make sure it covers all your current needs, potential needs, and fits your budget. Here are some questions that you want to ask yourself:

- Does anyone in your family has a pre-existing condition?

- Do you or your partner have any genetic conditions that you may be susceptible to?

- Do you want to keep your current doctor

- Do you plan on growing your family in the near future?

- Do you travel a lot? Or will you be taking any family trips in the next year?

- Do you need vision, dental, or any other supplemental health insurance plans?

- What can you afford to pay for coverage each month?

Once you have an idea of the coverage you want, it’s time to start your shopping. You can either wait for the Open Enrollment Season, and get coverage through the marketplace, or you can look for family health insurance at any point outside the marketplace. If you opt to choose a plan off of the Obamacare exchange, you won’t be eligible for any federal subsidies, but may end up finding a cheaper family plan.

It’s recommended that you begin your search for family coverage with an agent because they will help you navigate the complex world of health insurance. They will also compare health insurance quotes for you, which eliminates a lot of the work.

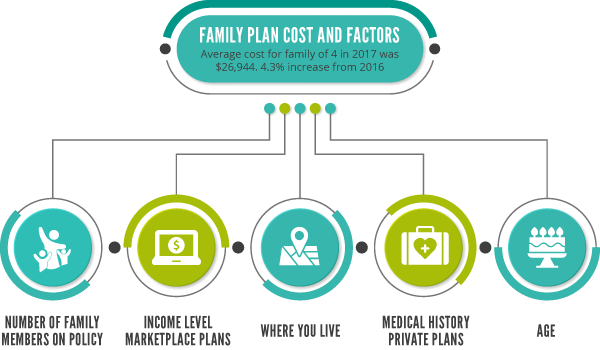

Average Cost Of Family Medical Insurance

Depending on the health coverage you are looking for, the number of people in your family, and the area you live in, the cost of your coverage will vary. Depending on your income level, you may also qualify for federal subsidies through the marketplace. The most accurate way to find the cost of your coverage will be to get family health insurance quotes.

According to the Milliman Medical Index, the average cost of health insurance for a family of 4 was about $28,166 in 2018. This number was about a 6.0% increase from 2017.

Finding Cheap Family Coverage

Even the savviest consumers struggle to find the cheapest family coverage options. With so many options to choose from, comparing family health quotes often turns into a stressful and frustrating ordeal. Luckily, there’s an easy workaround to this problem, and it starts with FirstQuote Health.

You never want to enroll in the first plan that you find, because you’ll never know if it’s your best option. FirstQuote Health helps people, just like you, find and compare the best family health insurance quotes in their area. With straightforward, easy to read quotes clearly laid out side by side, you’ll be able to quickly browse plans and pricing in your area.

Outside of free tools like FirstQuote Health, you’ll also want to take a look at the health insurance marketplace. As mentioned above, you may qualify for subsidized health coveragefor you and your dependents based on your income level. If you are eligible for federal subsidies, then you may be better off enrolling in coverage through the ACA exchange.

Are There Free Options?

It is possible to get fully subsidized, or free health insurance for your entire family. Depending on your income level, your children may be eligible for the Children’s Health Insurance Program, and you and your partner may be eligible for Medicaid.

If you make too much money, or you are not eligible for federally funded health programs, you won’t be able to find health insurance for free, but you may be able to sign up for a cheap family health plan that doesn’t offer comprehensive coverage, but will keep you protected in the event of a medical emergency.

Is There Still A Penalty If You Family Isn’t Covered?

Starting in 2019, under President Trump, the individual mandate was eliminated. That means you and your family will no longer be penalized for not enrolling in a qualified plan healthcare plan.

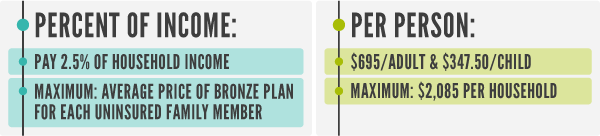

Under the prior administration, there was a tax penalty levied against individuals and families who weren’t covered by a plan qualifying health plan. While you don’t have to pay this tax penalty moving forward, there is a chance it makes a comeback, which is why we’ll still provide you with what you would have had to pay without coverage. You can also calculate your old penalty with our Obamacare Penalty Calculator tool.

- Percentage of Income: 2.5% of your household income, with a maximum of the average price of a bronze plan through the health insurance marketplace.

- Per Person: $695 per uninsured adult, and $347.50 per uninsured child, with a maximum of $2,085 per household.

Unless you qualify for an exemption, you would have been liable to pay whichever penalty is higher.

Why It’s Still A Good Idea To Stay Covered

Life is full of unexpected surprises, which is why it’s always a good idea to keep yourself and your family covered. For starters, health insurance plans for families are designed to offer a multitude of benefits to everyone on the policy. That means you will save on things like preventive services, trips to the ER, and more. You’ll also keep your finances safe from the increasing cost of healthcare.

Compare Family Health Insurance Quotes

Now that you have a better grasp on the basics of family health insurance, it’s time to start your search. You can easily compare family health insurance quotes with FirstQuote Health by entering your zip code. Talk to an experienced agent, or simply view different plans and pricing in your area. You can get your the family healthcare coverage you need as quickly as today.